Table of Contents

Index(Nifty/Banknifty/NiftyIT) Data OI Analysis as per participants below

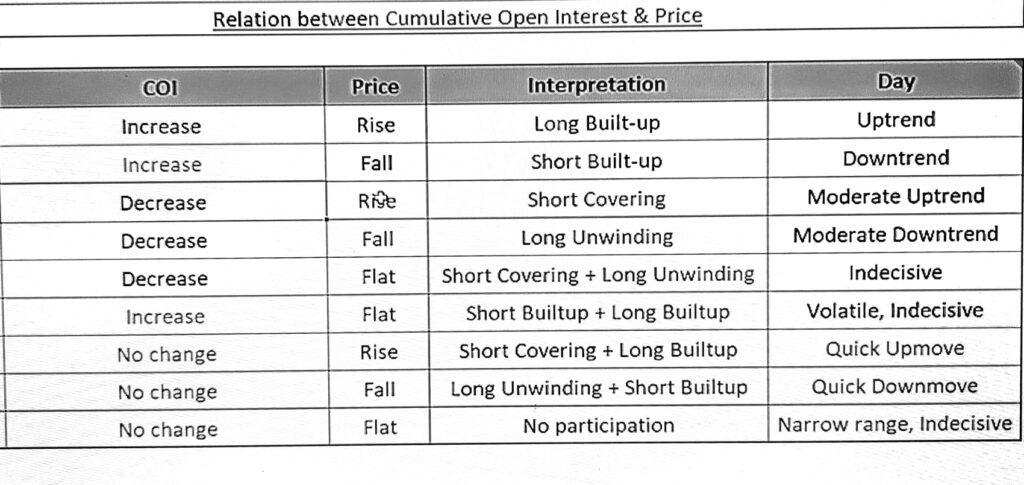

First, Open Interest in Cumulative OI in futures is

in pdf is given here oi behaviour with coi futures

we are only intrested in days where there price movement up or down. Together with futures coi gives idea what is going to happen. 6 scenerious we can trade below…

- say futures coi is increase with price then long builtup is formed.

- price down with futures coi increase short builtup

- price up and coi down shortcovering postions

- price down and coi down long unwinding positions.

- no change is coi and price up then a quick upmove is posible

- no change in coi and price down then quick downmove is possible.

Index Futures participant wise OI data results

Futures is simple, if more long than bullish and if more net negative then bearish. Compare it to previous historic data…

Index Options partcipant wise OI data results

Simple points: If FII are postions are

- positions are positive on Call side then bullish

- Positions are negative on Call side then bearish (Short side on Call)

- Positions are positive on Put side then bearish

- Positions are negative on Put side then bullish(short side on put)

If mixed signal is generated then compare bullish numbers to bearish numbers and see if there is any trend expected or not.

Stock Open Interest Data Analysis as per participants below

Stock Futures participant wise OI data results

Stocks Options partcipant wise OI data results

Simple points: If FII,DII,Pro are postions positive and increasing can go up..(mainly FII)