BEAR AND BULL TRAPS AT MAJOR LEVELS

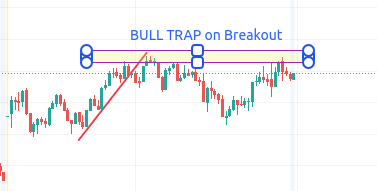

BULL TRAPS

Bull traps might also be viewed as places where price is divergent. In other words, there are two highs where the second one is failing to hold higher and eventually pushes the price to a new low as the example to the left shows.

BEAR TRAPS

Bull traps might also be viewed as places where price is divergent. In other words, there are two lows where the second one is

failing to hold lower and eventually pushes the price to a new high as the example to the right shows.

BULL&BEAR TRAPS VS. BREAKOUTS

The majority of retail traders do actually love to trade breakouts.

Trading breakouts are very easy to fall in love with because of:

1) They are simple and thus do not require a lot of guess work.

2) Breakouts are also logical, although not so efficient.

CONS OF USING TRADING BREAKOUTS

I personally don’t like using breakouts, because of their nature. They are easy and that is one of the reason why so many

traders prefer to use them. That is also the reason why they are not as efficient. Hence, I came to the realisation (through bad

experience initially) that trading the bull&bear traps is a much better way to approach the

markets.

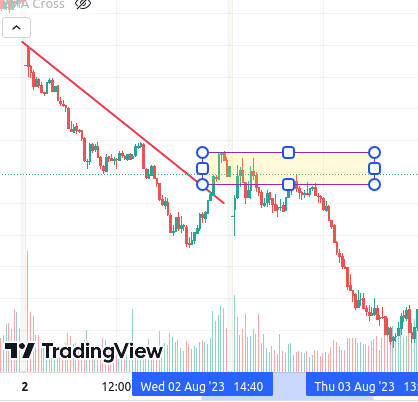

BULL TRAP EXAMPLE

Below is Bull trap induction type where the stop losses are wiped first before market going down.

THE BULL TRAP EXAMPLE (ABOVE)

An experienced trader might have not fallen in this “bull trap”, but the majority of retail traders do actually love to trade breakouts.

They are simple, logical and comfortable. To trade “The Trap”, you will need more experience or guidance from

someone experienced. As you can see from the example above, this false bullish breakout (or bull trap) reversed the trend completely.

Now, if I were you, I would think twice before trading breakouts!

MORE REASONING WHY I DON’T LIKE TRADING BREAKOUTS

Human nature does not like to question probabilities and as such falls into the trap of believing the

obvious.

One of the reasons I do not like to trade breakouts is because there is a lot of guesswork involved. Traders

stop reading the market and fall prey to bad habits and even worse- lose in trading.

HOW TO TRADE THE BULL TRAP

There are two things that are important for a bull trap trader:

1) Strong resistance level formed by a previous high

2) Price action confirmation of reversal like a bullish rejection candle, inside bar or a bearish engulfing pattern

HOW TO TRADE THE BEAR TRAP

There are two things that are important for a bull trap trader:

1) Strong support level formed by a previous high

2) Price action confirmation of reversal like a bullish rejection candle, inside bar or a bearish

engulfing pattern

BULL TRAP DEFINED

At the top, where the bull trap forms, two things happen:

1) A lot of traders that were long the trading instrument are reaching their targets (a major resistance level) and are exiting positions.

2) A lot of traders that were waiting for the price to reach the resistance level are entering in short trades.

The cumulative effect of long traders exiting (closing) their long trades and of traders shorting the trading instrument at this level is so strong that it:

1) Leads to a bull trap

2) Pushes the price aggressively lower, thus changing the direction of the trend (at least for the short term)

BEAR TRAP DEFINED

At the bottom, where the bear trap forms, two things happen:

1) A lot of traders that were short the trading instrument are reaching their targets (a major resistance level) and are exiting positions.

2) A lot of traders that were waiting for the price to reach the support level are entering in long trades.

The cumulative effect of short traders exiting (closing) their sell trades and of traders going long at this trading instrument at this level is so strong that it:

1) Leads to a bear trap

2) Pushes the price aggressively higher, thus changing the direction of the trend (at least for the short term)

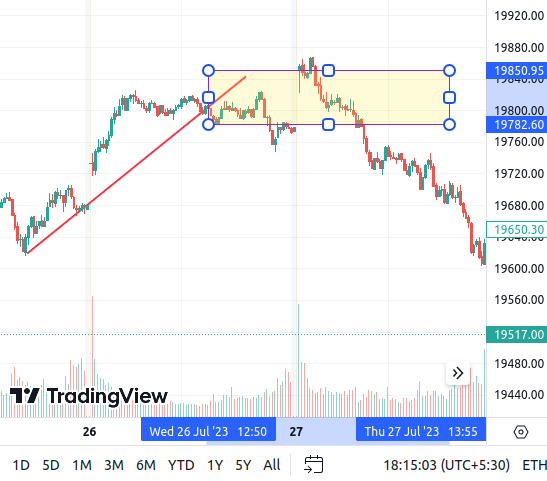

EXAMPLE 1 OF A BEAR TRAP

In this particular example, we have the two criteria for a bear trap, which are the same as for a bull trap:

Strong support level Confirmation from a price action setup, which in this case is a sequence of bearish rejection candles, including a pin bar From the information given above, you can see that nothing much changes. Bull and bear traps do meet the same requirements and they are as powerful.

EXAMPLE 2 OF A BEAR TRAP – Induction type where stop losses are wiped before going down

This is a second example from a different instrument and different timeframe. It proves that no matter what instruments you are trading or on what timeframes, the same principles apply.

I have marked with “bear trap” the place where traders are attempting to enter in a breakout trade, but price action quickly disproves them. There is a pin bar candlestick, which quickly reverses the direction of the trend.

SUPPORT&RESISTANCE vs SUPPLY&DEMAND AND BULL&BEAR TRAPS

It is important that you don’t just blindly follow and trade those setups. You should have a methodology and a way

to enter in a trade minimising your risk and maximising your profit potential.

I am using bear and bull traps in conjunctions with supply and demand zones and that is why you understand this

material well.

I believe that support and resistance, supply and demand and bear and bull traps share common characteristics

that and you will see that in the trading videos that come with this course.

Lets Continue to our Next part of this tutorial defining Supply and Demand in more detail